portland oregon sales tax 2019

Tacoma 102 percent and Seattle 101 percent Washington and Birmingham Alabama 10 percent. Did South Dakota v.

Ornamental Cast Iron Gate Top Vintage Patio Furniture Vintage Patio Cast Iron Gates

Is subject to the Portland Business License Tax.

. However Oregon does have a vehicle use tax that applies to new vehicles purchased outside of the state. A Large Retailer is defined as a business that. This is the total of state county and city sales tax rates.

From Retail Sales of 500000 or more in the. Oregon law doesnt allow you to reduce your Oregon taxes because you paid sales taxes in another state. City of Portland Oregon.

Download PDF file SP-2019 - Combined Tax Return for Individuals Fill Print. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. Broad body of sales tax law to look to for potential guidance regarding the taxation of retail sales.

Capital gains in Oregon are taxed at your state income tax rate. All businesses must register Registration form or register online If you qualify for one or more of the exemptions you must file a request for exemption each year and provide supporting tax pages. Sales tax region name.

The minimum combined 2022 sales tax rate for Portland Oregon is. The 2018 United States Supreme Court decision in South Dakota v. Information about Portland Business License Tax Multnomah County Business Income Tax and Metro Supportive Housing Services.

Wayfair Inc affect Oregon. 2022 Oregon state sales tax. Do Your 2021 2020 any past year return online Past Tax Free to Try.

The City of Portland Oregon. Portland Tourism Improvement District Sp. Easy Fast Secure.

Neither Anchorage Alaska nor Portland Oregon impose any state or local sales taxes. The Portland sales tax rate is. The conversion of most OMMP.

The entire state of Oregon including Portland has no sales taxes. If youve lost your bill use this form to make a payment. 2019 PortlandMultnomah County Combined Business Tax Returns Individuals.

Honolulu Hawaii has a low rate of 45 percent and several other major cities including. Compared to fellow Northwestern city Seattle with its 101 sales tax Portland looks like a bargain. For example under the South Dakota law a company must collect sales tax.

2019 the Clean Energy Surcharge CES is imposed on. Easy Fast Secure. The Oregon sales tax rate is currently.

The County sales tax rate is. Evidenced by the 198 million in state and local sales tax revenue generated since legalization. 2019 tax year10 Estimated payments for the surcharge will be due using the Citys estimated tax calendar for the.

Inventory at the Made in Oregon warehouse in Portland Oregon July 24 2019. Supreme Court ruled a state may collect sales tax from taxpayers located outside the state if they are selling to state residents and there is a sufficient connection. The Portland sales tax rate is NA.

From Retail Sales of 1 billion or more in the tax year. As we all. Download PDF file 2019 Arts Tax Return in Vietnamese Tiếng Việt 74651 Kb.

2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income. Tax rates last updated in January 2022. The CES is imposed on certain retail sales of large retailers.

On November 6 2018 Portland voters passed Measure 26-201 which imposes a 1 gross receipts tax on large retailers. Three cities follow with combined rates of 10 percent or higher. On November 6 2018 voters in Portland Oregon approved Measure 26-201 the Measure which imposes a 1.

On the demand side the establishment of a legitimate market has resulted in con sumers shifting their purchase activity away from the illegal market to licensed retailers. The minimum combined 2022 sales tax rate for Portland Oregon is. Online PDF Do not use this form to make a quarterly payment.

2019 the Clean Energy Surcharge CES is imposed on businesses that have at least 500000 in Portland gross income and 1 billion in total gross income. Has Portland gross income. There are six additional tax districts that apply to some areas geographically within Portland.

Annual Exemption Request required annually for tax year 2019 and prior. Corporations exempt from the Oregon Corporation Excise Tax. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County.

The Portland Oregon sales tax is NA the same as the Oregon state sales tax. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected. Once you have verified you.

The New Oregon and Portland Taxes on Gross Receipts 60 for MBA members 95 non-members In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. The Wayfair decision and online sales tax On June 21 2018 the US. The company is now collecting sales tax for online sales in at least 11 other states.

Has total gross income. Instead of the rates shown for the Portland.

Botega Rattan Bench Cheap Bedroom Furniture Furniture Home Furniture

The Coziest Teddy Bear Jackets And Pullovers Life On Shady Lane Bear Jacket Teddy Bear Jacket Jackets

Pin On Moving To Portland Oregon

Oregon Economic And Revenue Forecast December 2019 Oregon Office Of Economic Analysis Economic Analysis Oregon Forecast

L Affiche De Woodstock 50 Dead And Company Robert Plant Gary Clark Jr

A Toronto Home With An Expert Pairing Of Art And Mid Century Modern Accents Style At Home Modern Kitchen Design Home Decor Kitchen Kitchen Interior

Navigating New Sales Tax Rules In The Era Of Online Shopping Marketplace

23486 S Central Point Rd Canby Or 97013 Mls 19398495 Zillow Canby Zillow House Styles

Pin By Katie Sharon On Pacific Northwest Trip Rental Quotes Rv Quotes Cruise America

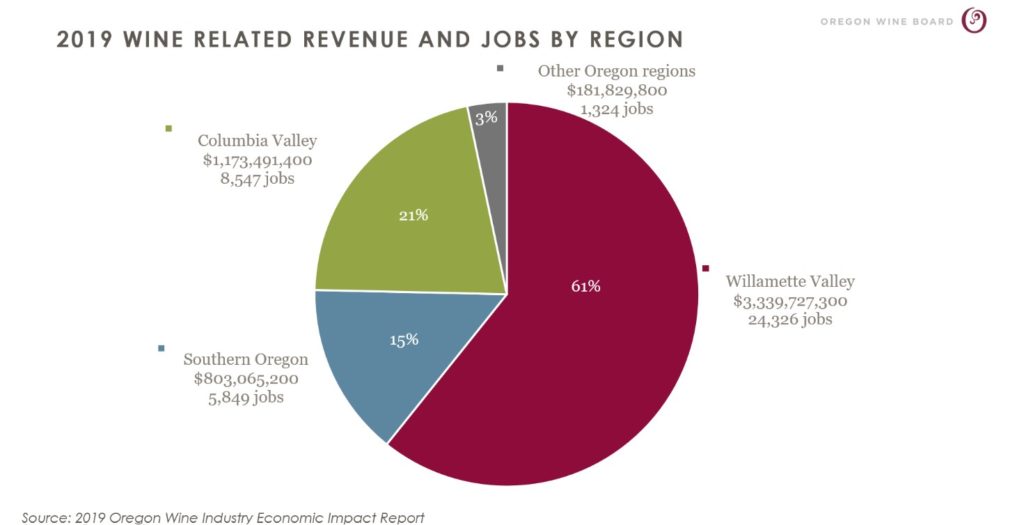

Oregon Wine Industry Continued On Its Long Term Growth Trajectory In 2019 But Encountered Headwinds In 2020 Oregon Wine Industry

Oregon Man Donated 75 On Tax Return But State Took Entire 1 185 Kicker Rebate Kgw Com

How Tax Evasion Fuels Traffic Congestion In Portland City Observatory

Corporate Tax Transparency Is Right For Oregon Oregon Center For Public Policy